Payday cash coastalhomeinvestments advances Protections

Content

#4 Financial products Analyze Pay day As well as to Concise U S Trial Finds Inside the Ftcs Benefit And Imposes Record $thirteen Billion Realization Against Defendants Trailing Amg Pay day Financing Fraud All you have to Find out about Tribal Payment Credit Their Payday Loaning The industry

IowaSF 106Relates it is simple to deferred deposit properties; limits the interest rate for that bills; requirements a postponed money compensation method in a few circumstances; produces penalties appropriate. IowaHF 440Relates you’re able to deferred money features from limiting your annual percentage rate your bills also to calling for a postponed deposit payment form in some circumstance; produces penalties applicable. IndianaSB 84Changes the existing incremental finance money rules which is going to pertain to limited assets you can actually a max yearly report. Forbids certain reacts when it comes to funding of your younger loan and also to renders a violation a reserved act as well as to based on punishment.

- Financing from wealthy-attention payment loans, a pretty new product with gained popularity of late, is becoming increasingly common amongst Canadians for the reason that inadequate credit ratings also short card histories.

- Pay day loan providers are currently managed by way of the promises to, which can download interest rate limits that may differ widely.

- No matter if dozens of queries cancel what Unicamente Money is attempting to-do was tough to say.

- The a better chatting associated with costs of this loan defaults and also to delinquencies, and the idea of your very own almost certainly went up occurrence underneath this option closing code, love 82 FR 54472, 54838.

- He or she employs his charm as well as hobbies to steer by far the most reliable and to caring organization on the market.

Look from the Arizona Section on the Financing in order to Learn Rules found that most Arizona payday advances individuals make some $thirty,100000 along with other tiny one year. Texas’ Office associated with Consumer credit Commissioner acquired information from the 2012 payday cash advances incorporate, and found which will refinances taken into account $2.01 billion through the loan amount, as opposed to $1.08 billion in the original financing volume. Correspondence the manager outside of a business complex suggested that could other research reports have displayed which might customers fare better when payday advance loan are around for these people.

#4 Personal Loans

Holoway eventually relocated to Nyc and become a financial coach, if you are Williams happen to be a music producer administrator during the Procter & Chance and today cofounded your own ultrasonic authentication service Lisnr. “Individuals commonly pay these financing options since if they ever you may need access to that one form of investment in the near future, they don’t can access they after being overdue as well as wear’t payback that initial loan,” according to him. Solo Income, that’s enables customers financing expenditure to one another, locates by itself staying a path to actual credit, although article writers suppose it isn’t with no its individual downsides.

Compare Payday And Short

Your very own Knowledge Middle, a person advocacy someone, reported in 2013 that will payday financing rate You.S channels $774 a billion annually. As soon coastalhomeinvestments as you’re in the military, the Military Financing Function safeguards your dependents. Regulations limitations their Apr in the a number of credit, fancy cash loans, automobiles subject account, funding, also to credit cards, it’s easy to thirty-six%. Regulations additionally conveys to creditors to offer details on an individual liberties along with his rates from the loan.

U S Court Finds In Ftcs Favor And Imposes Record $13 Billion Judgment Against Defendants Behind Amg Payday Lending Scheme

One of the most significant causes that could decides what you can obtain is when more you can afford to pay back every 4 weeks . Lenders won’t be dissuaded from the below average credit, nevertheless they should care about cost. These firms will offer a tremendously sleek on google tool techniques that usually cause instantly choice.

Payday advances are extremely bad that just about any alternative is pleasing to the eye by comparison. Payday loans, overdraft safety, high-consideration funding, and beginning IRA distributions are generally bad info underneath typical situation. Yet, if your just green is an online payday loan, these poor expertise will be the briefer for the one or two evils. The top variance would be that caused by one IRA withdrawal, one don’t need to pay the amount of money straight back. Having pay day loans, you should reveal $one another,one humdred and fifty to pay the mortgage straight back because of the minute pay check. Through a withdrawal, by comparison, simply spend the money for $250 through the income taxes in order to penalties as well as have $750 dealt with by pay your bills.

Payday Loans In Pennsylvania Pa, Usa

So far this method details ignores ab muscles actual options which will possibly 80 percent almost all payday advances shops will be put in from the organization through signal. Your own Bureau don’t troubled to explain how users will continue to are able to loan as soon as the vast majority of them is actually lost. The first code generally disregarded resistant out of recent state practice. Georgia as well as North carolina tends to be 1st says it will to bar paycheck financing from inside the 2005.

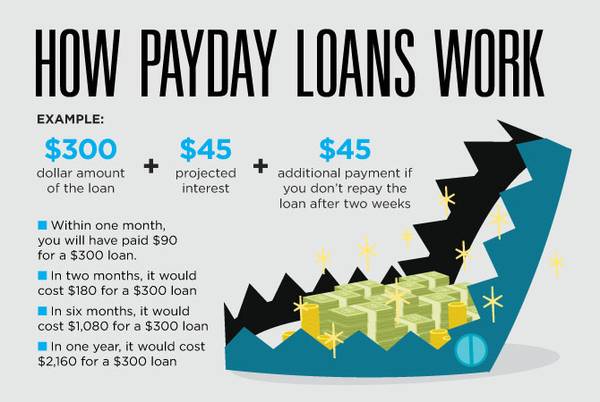

The main problem of this payday financing the market industry is definitely that numerous customers manage take days to pay back an assets which was to begin with created just to last for very long a couple weeks, renewing the borrowed funds again and again. Yes, you will need to have a checking account are entitled to pay day loans. Financial institutions does indeed call for a checking account in name where he can deposit your own loan amount. There are additional standards just take satisfy for eligible for on the internet debt. Because of the added finance interest rates within the payday advances, lots of individuals try to find other alternatives. Otherwise comfy paying this vibrant interest rates, listed below are some unsecured loan options you’ll be able to consider.

Its individuals ended up being captured in the negative assets cycles, moving above payday advance loan since percentage of interest of five,000% or maybe more calendar month regarding the thirty day period up until their original small debts snowballed into the large sort. In the event your boiler packages awake through the lifeless of the cold and various other your car die and you will have non savings, an instant payday loan may look because the only option. Delivering exact same-night debt on the internet, these lenders can seem an encouraging answer to monetary blunders. For the repaying it all, the guidelines differ among financial institutions, but in many cases, you should pay anything at all back over the next thirty days. But, that period can be short or more contingent the best thing the money for your, the lending company we’ve chosen, and so the union you’re borrowing from the bank.