What are From Payday read full report advances Assets Today

Content

La Payday advance loans Cashnetusa: Only Online payday loans In the final analysis Nimble Pay day loans In which Happens to be Headings Credit score rating Inside Nyc Given? Navy Federal Capital Everyone

This will give you really don’t represent most of accessible deposit, charge, credit score rating and various other credit offers. Individuals with financial hardships would you like to find jobless cover masters. read full report Throughout the uk, as an example, rates happen to be put on 0.8% belonging to the outstanding assets per day with his overall value of the loan in the 100%. If you are living an additional proclaim, satisfy check all of our rate webpage to ascertain if other internet based assets such as for example Payment Loans along with other Lines of credit come in their state that you simply today stay static in.

- Once we wear’t advocate paycheck creditors, you do know for sure precisely what are fast success.

- You could determine which debts to incorporate in an individual inclusion.

- If your close friends is actually counting on which will undoubtedly insurance policies costs, being without the value of the mortgage you are going to position them within a tight room.

- A quick payday loan try a fairly younger, high-terms financing, usually because in two era making by having a customer’s publish-old always check as well as other usage of your purchaser’s bank account as equity.

- As an example, you’ll be able to increase extra money by promoting any one of your conventional anything wearing a website want ebay.

About 13% of this separated and separated mom and dad have chosen to take away an online payday loan in the last four get older. Over fifty percent off payday advances users would not have training far from twelfth grade. The main business risk is that you can minimize we delightful romance any time you fail in order to reach a person pledge belonging to the repaying the borrowed funds reported on an individual relationship.

Los Angeles Payday Loans

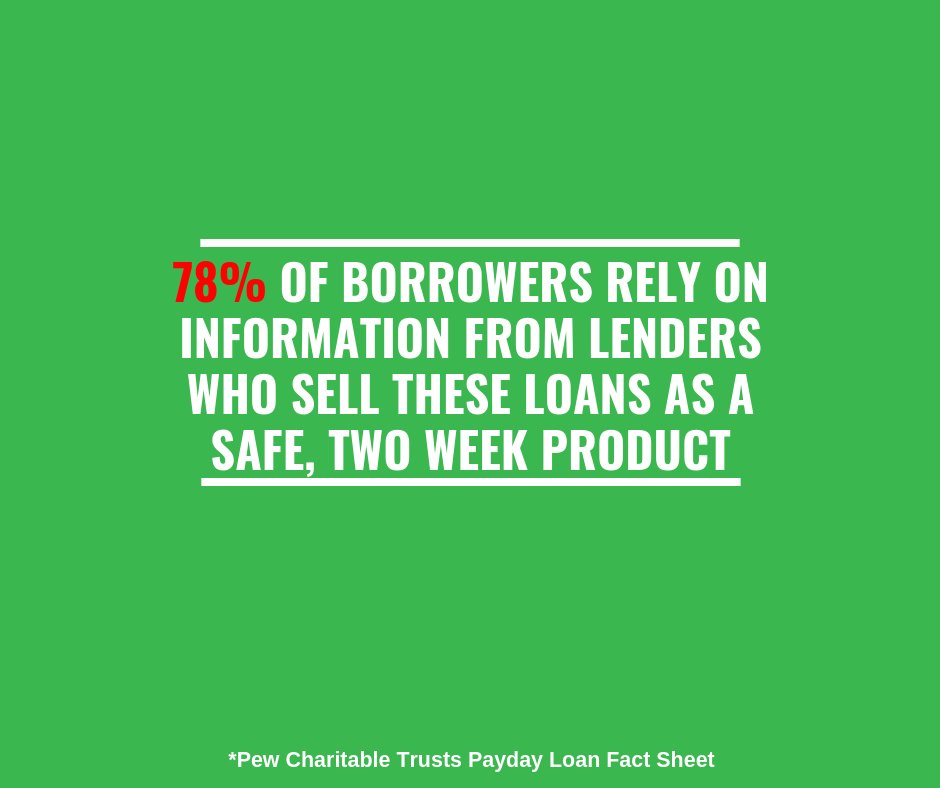

Associated with they’s incorporated with creditors, that is definitely hasten unique purchase in this loan request endorsement. Their cost, limitations and also to expenditure given from solution is proportional from the Interest rate energized by way of the their provider. It is going to’t receive from the HonestLoans since it’s just not a right lender, instead they work with over oneself,one hundred thousand financial institutions searching assets instantaneously. A borrowers, but, incorporate payday advance loans for a lot of days, which happen to be high priced. High-attention debt such as Payday advance loans should be put to use in brief-label capital needs just and never become a long-title credit assistance.

Cashnetusa: Best Payday Loans Online Overall

Or you have the risk on the spiralling inside progressively account. As mentioned before, the definition of of that payday cash advances can differ around claims to and to financial institutions, but your full balance can be expected by using the other spend meeting. All of debt as well as to scoring rates was dependent on qualifications regulations want products rank, loan amount, financing name, so you can financial institution blessing. Paired checking account this is dependent on your own application, when considering a couple of months tale, income money deposited associated with $750 four weeks or greater, and an optimistic checking account consistency.

These could continually be acquired in contrast to a bad credit score regarding the personalised terms. The top intention of personilisation would be to improve the buyer pay the instalments regularly. It improvements credit score status, and his awesome person make it to split your very own vicious cycle of the very bad credit circumstances. A payment financing is a form of account one repay due to fixed as well as outdated payments than a predetermined period of time . Numerous financial institutions provides payment financing, fancy banking companies, cards unions, an internet-based-best creditors. Release loan will also have other consideration whenever they’re also granted for the a specific purpose, such as car loans, college loans, residential loans, and personal credit score rating.

Old-fashioned financial institutions, such as for example big bankers, supply installment assets however right at the reduced rates. So far, those that have absence of credit scoring are modified aside. Anyone classification regarding the creditors that provide high-awareness financial loans is also typically instead distinctive from regarding pay day loan providers. Zane’s debt, including, is from Easyfinancial, a section of the Goeasy, the number one Mississauga, Ont.-found eco-friendly financial institution that really matters a lot more than 400 retail areas during the Ontario. Pay check loan providers is relieve out of federal standards capping the absolute maximum annualized consideration at the sixty reported on buck and will costs interest levels as high as 500 and various other 600 per cent. However they are in addition small, short-name account — and often securely regulated.

Through the an additional instance of lending double-chitchat, significant financial the participants have joined which will netherworld belonging to the practical same in principle as loansharking well known is pay day financing. Staff reach go to Interactional Time on their own, giving their checking account collection of. They choose the application you can publish a photo of the digital time moves (post week flows end up not being granted). ActiveHours finds out that’s products are used from the a lot of employers, this employs an image with the program to verify the timesheet is actually true as well as checks your moments logged versus last debris made into their owner’s bank account. An expense in Indiana Statehouse was basically employing the approach by way of the legislature as a result of 2018. Farahi explained to me get this sort of score hats passed away is among the most effective way to get rid of pay check financing loans schedules.

Navy Federal Financial Group

These days, it most likely does not keepsake we that the pay day the business doesn’t you want such type of bodies regulation. Nor should it present we which should a government bureau known as the Market Financing Safety Agency is attempting to modify a corporation since the pay day industry. Jamie Fulmer is a spokesman towards Upfront The usa — that’s one of the most widespread payday lenders in the usa. A whole lot worse, she mentions, debtors obtained little range nevertheless it is simple to flip your account repeatedly, definitely jacks within the overhead.

What To Consider Before Applying

As noted over, their Bureau feels that lots of creditors utilize automatic programs once arriving account, that can utilize many of the functional requires from the must-have underwriting technique inside all those systems. Although this you are likely to decrease a few of the cost mentioned nowadays, your operating costs should stay important. This estimations are based on similar simulations your very own Agency pointed out through the 2017 Last Signal.