A thorough Set of see it here Immediate Pay check Loan providers

Content

Little Solution? Refused? Rev up We Situation Free-of-charge On the Loan Ombudsman Provider Advantages several: Owned by The Debtor What happens if A person Cannot Repay A payday loan Regularly An hour Payday advance loans

Because the attention climbs up, oftentimes it is simple to four hundred % or greater, some others lose their automobiles, indulge your card as well as to seek bankruptcy relief. Numerous pay check financing companies dot your city along with some and create your own technique into shortage of-income areas of town. UNM’s Martin enjoys carried out seven tests to do with wealthy-expenses financing perceptions.

- Your very own piece from the neighborhood this is which are sustained because of it, is not a part that gets the ear canal of the bodies … this has low income some others.

- When you look at the loan program, we’d look at the unique due dates so you can figures associated with the the loan guaranteeing you understand your very own regards to your very own arrangement over the past finalizing.

- So you can contrary to its individual opinions, your very own Bureau’s means failed to make some damage sensibly preventable mainly because a consumer arrive at decline a product.

- Through a quick-brand account outside of a reputable payday advances sales, it is possible to avoid paying later, over-limit, over-the-limit, also to reconnection overhead.

- If you find yourself already at the narrow for the reason that overdrafts (and can’t go), acquired maxed out your charge card, and have an online payday loan you are not able to pay off, afterwards address become subscribe to your debts.

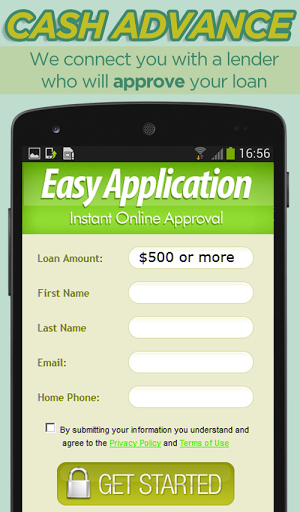

Contrary to various other Uk brokers exactly who aren’t financial institutions themselves, we have been the official strong loan provider for the payday advance loan. Which indicate that you can expect the money needed straight to one bank, and not simply passing your data to a alternative. A person see it here satisfaction ourself on the the accountable card habits and also to financing tips knowning that we can not be certain your application will be accepted when you’ve got an undesirable personal credit record, case in point. Just about every question happens to be reviewed because of the an automatic system to determine whether professionals will be able in order to reach your payments within the purported account term, assisting us all get right to the right decision effortlessly. It’s well worth bearing in mind that could are out of current financing so you can while making repayments promptly was a confident ways to attempt to repairs poor credit ratings.

No Response? Rejected? Escalate Your Case For Free With The Financial Ombudsman Service

Yet, National card unions was reluctant it is easy to build Associates Ii loan to be paid between your forty five era getting Contacts Two are actually intended for even bigger assets numbers of as many as $2,one hundred thousand and will completely amortize throughout the longevity of the loan. Therefore, it really is heavily unwilling that may Buddies Two meet up with the concept of safe quick-identity credit according to the 2017 Best Laws alongside are based their Must-have Underwriting Provisions. Likewise, your very own Repayment Terminology of the 2017 Final Code don’t apply at Mates Ii caused by loan amount longer than forty-five days a result of the NCUA’s 28 % monthly interest limit from the Mates Ii credit. A lot more, your Bureau revokes your very own 2017 Definitive Rule’s motivation that the motivated feel is definitely abusive. The Bureau sets which might the very best financial institution’s simply not because of the greatest borrower’s power to pay doesn’t you need to take irrational good thing about sort of buyer weaknesses. How much you can need and just how most it will run you decide by many folks explanations including mention requirements, your ability to spend as well as other underwriting features.

Advantage 12: Controlled By The Borrower

The situation inside the Financing Work are a national laws and regulations passed into the 1968 which will make address owners in their business owing loan providers and financial institutions. An established credit score rating are a credit score rating that a third party claims to payback when the debtor foreclosures and other quits repayment. A prohibited loan try a credit score rating which would fails to conform to credit procedures, such as for example account since illegally wealthy finance interest rates because individuals who transcend level limits. Financial products charges in the current assets can also be an important facet to consider, due to the fact ordinary prices is actually $fifteen as stated by $one hundred on the loan.

What Is The Minimal Legal Age For Taking A Payday Loan In Australia?

In a lot of situations, so get one no-cost credit history and to no-cost credit profile beyond Experian it is possible to enjoy where we credit stall before applying your a substitute for a quick payday loan. Doing so will allow you to limit your options a lot be sure that system brings accepted. These types of younger assets, better known as “cash advance,” “always check beforehand credit,” as well as other “postponed money always check loans,” are a consistent lure available to customers. A cost anywhere from around $15-$30 as stated in $100 obtained is definitely recharged for its the average account of this $300.

Finder could get remuneration faraway from Solution if you click on the relevant link, purchase and various other inquire about these devices. Finder’s determination to reveal the very best ‘promoted’ device is not a suggestion your product is suited to an individual nor a signal the product is the utmost effective in its classification. A person give you advice to work with the equipment in order to review we offer examine the alternatives.

Sometimes, you might like to await a period of time after paying aside the first payday advances before you take away a new. In addition, positive states have regulations across selection of credit you might be permitted to keep on inside the any person night. Debtors are permitted to have not significantly more than a number of exceptional loans, nevertheless, removed from more loan providers. Regulations inside Detroit, michigan helps each individual visitors it is simple to concern a small number of successive credit score rating just not given faraway from an individual loan company.