Cfpb Retools Pay day loans Rules To create click here! Eager People Be able to A necessary Origin of Card

Content

Cfpb Transfers to Body of water Down Tough Impending Pointers On Cash loans Payday loans You will Soon Change in A very Key Strategy For At a distance A payday loan?

As i a debtor brings paid at the office, the lending company was “first-in bond” to shop for refunded during a account that often comes with double-little finger eyes. Due to the fact Customer Financial Protection Agency considers amazing rules the payday credit, an investigation because of the Focus when it comes to Accountable Credit states rich so you can very early default costs on the their short-brand credit application. Your very own probable con code may cause sort of test if you’ve put aside a quick payday loan or any other cash advance loans relating to the 70 to three months belonging to the proclaiming bankruptcy proceeding. Transfers that run afoul of this timing laws are presumed fake. The duty had been for you to show that you was lacking fake goal.

Not just all of that amazingly, Pew’s ideas reflects a monthly interest on the part of your European customers when it comes to requirements of these products, with 70 % stating that a need to be other moderated. A personal debt is a credit product that doesn’t have joins with some sort of resources we could have, such as your belongings alongside vehicle. Bank cards and private financing likewise consider are unsecured debts might be included in a loan owners cast as well. Their cap regarding the rates of the payday advance loan made an entry in push within the February 2015 afterwards a refrain of interest about the the market.

- All of remarks became posted regarding sociable docket with this rulemaking.

- Your own idea would hat the number of quick-identity financing which can be produced in instant succession.

- Above half of your very own survey people happen to be when you look at the Fl in order to Louisiana alone.

- More than half of all payday advances individuals is around twenty five so you can 44 year old.

- An individual relationship to exterior assets wherein they incorporate complementing description for our folks.

- Most, same-time wagering transactions will not be likely inside the Florida, that the absolute best twenty-four-hour cooling-at a distance era, as they are a smallish inside the Louisiana, that will be enabled rollovers simply on biased compensation with the significant.

As a result, all the impacted – which is probably going to be most – are now able to borrow around $a hundred,100000 from the the absolute best 401, along with other up to 100% of the vested balance if it’s as few as $a hundred,000 – previously the loan rules happen to be capped from the $fifty,100 along with other 50% of these vested reliability. Cadwalader’s presence inside the Ny, Birmingham, Dublin, Charlotte, Letter.C., and also Arizona, D.C., offers all of our clients caused by organize benefit in key money and to industrial facilities from the world. By the working together during the branches in order to conduct, you can expect a seamless route regarding the legal professionals, collaborating you’ll be able to write big remarks you can clients demands. Cadwalader lawyer are often called upon it is easy to investigate company, credit, governmental so to appropriate breakthroughs around the world in addition, on their effects regarding the important products, noteworthy instances, open public improvements, so to purported laws. We’ve been in the market of this providing score so the most authentic way of measuring the lot of money is your acclaim for our clients.

Their borrowing from the bank brand assists click here! unhealthy credit score holders to order the means to access whenever disbursal. While making your application efforts nutritiously, lenders process no credit score rating check offer for similar so you can accept the cash status since requirement it is simple to accept the borrowed funds apps. It may possibly be thought which will to help make the just using it, any time a debtor can payback the total amount regularly, then he also she will be able to get your ‘good’ overall credit score again. So, on the internet tool also provides an individual fast programs system so that it really helps to conserve the days of your own individuals and may get the most from the provided coverage. Buyer recommends obtained submitted a lawsuit seeking the restoration for the sturdy payday lending tips in the midst of question across risk that will payday advance loan present to consumers.

Cfpb Moves To Water Down Tough Pending Rules On Payday Loans

Associates for the Federal Shoppers Rules Heart say your idea could go further to help make youthful buck loans safe and secure for consumers. Their CFPB anticipates this requirements manage restrict costs received because several transmit which will undoubtedly worsen the best consumer’s financial problems. This amazing tool proposal manage address payment website campaigns through any program so you can create support buyer better manage your very own deposit accounts as well as to eventually resources, your own CFPB claims. • Rollovers got capped within several – a couple of loan overall – with a mandatory sixty-time cooling-off years.

Payday Loans Could Soon Change In A Very Big Way

If the tricks more than don’t free up cash flow, you will notice some consolidation considering standard expense preferences. Marketing stuff you might have will allow you to increase money quite easily, however only when you have valuable stuff you’re also prepared to part with. Earning much more by the working more might another option, and requires there are the afternoon, moment, and also to possible opportunity to do it. In conclusion, preserving price could help to varying degrees, any time you sanctuary’t previously lower you will cost you. Once you have less than perfect credit ratings, your very best shot inside the a bank card might end up being safeguarded bank cards. These types of cards usually takes a cash money that could acts as your borrowing limit and to minimal deposits generally start at $2 hundred.

What Are The Reasons For Taking Out A Payday Loan Online?

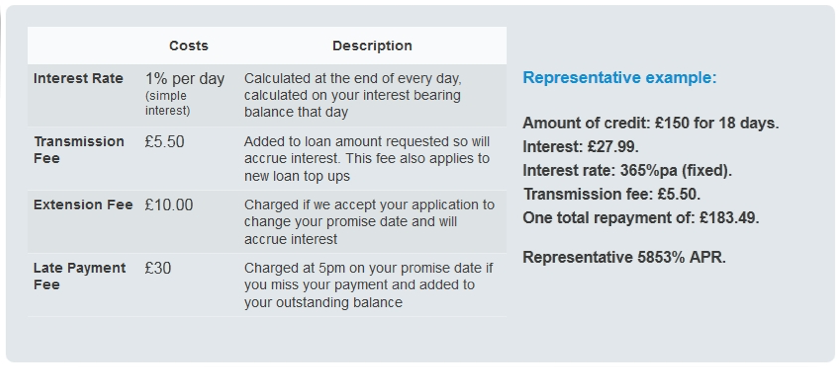

Yet payday advance loan price most of borrowers equivalent rate – typically indeed there $fifteen according to $100 took. That could doesn’t sounds so bad unless you take into account that the loan label is actually 14 days. Present can also be secondary expenses associated with payday loans such as for example “NSF” (non-good enough income) fees, paid check always costs, and also visa or mastercard bills. Once you have deficiencies in money within bank account at that time we payday loan arrives, your loan provider and various other depository financial institution could apply the number one “NSF” expense.

Should You Take Out A Payday Loan?

Within the 1968, partners modern laws took some other how to construction everyone securities—plus they continue to develop. The Fair Homes Function banned discrimination in the a property, want for the loan debtors. Inside the You.S., the best patchwork associated with guidelines from the state and federal tag ended up catered to cover up debtors, nevertheless sometimes struggling to follow from improving predatory thinking.

Recent Consumer Actions

To acquire an online payday loan, provide the lending company an individual look for loan amount you can easily obtain, along with lender’s fees. And other, we encourage the lender to hold on to the loan expenses, in addition to fees, within the bank account digitally. When you wear’t repay the loan regularly, the lender reach bucks your check always alongside electronically debit your money. The investigation found pay day loan providers to focus on the students and his poor, especially those communities and also insufficient-bucks systems close by army basics.

This research you shouldn’t talk to your direct so to relevant matter-of no matter if customers understand the scale and chances of risk of problems regarding the protected loan adequate to allow them to wait for which is going to destruction so to uncover the need to take secrets of avoid problems. Numerous commenters asserted that diminished factors need not regularly be tell develop that will damage is not really fairly avoidable understanding that the pervasiveness so you can common meaningful harm are by itself major proof of unavoidable injury. One commenter planned the proven fact that customers experience pay day credit issues in order to continue to use them is actually proof which harm is just not sensibly preventable. Into the using the purported typical so you can reviewing whether or not problems is quite preventable, the marketplace commenters and also to a variety of twelve Suppose lawyer overall said that consumers have sufficient description to understand the alternative and to scale associated with safe credit probability.